South Summit which aspires to be the “the Leading Innovation Global Platform focused on business opportunities and disruptive trends, that gathers together the entrepreneurial ecosystem” was held last week in Madrid. My employer, Amadeus, was a big contributor to the summit both as a sponsor and by providing speakers on various items related to travel and technology. In a strange twist of fate, my very generous colleagues in the Amadeus Corporate Strategy team – who must know that I adore the stage — asked me to represent Amadeus on a panel about “Rebuilding Industry through Blockchain”. How could I say no to the limelight?

Besides me, the panel consisted of a serial entrepreneur/angel investor, the head of Blockchain at a major Spanish bank, and a Palo-Alta based VC. While the other panelists focused on Bitcoin and the case for cryptocurrencies, I discussed the four main uses cases that Amadeus has identified for the technology: managing traveler identity, more user-friendly loyalty programs, improving payment settlements, and baggage tracking. And while everyone else on the panel hailed Blockchain’s potential to disrupt intermediation in raising capital, I stressed that when evaluating the technology’s use cases, we had to take into account our B2B customers’ needs as well as those of travelers, and that to date the biggest problem our industry faces with Blockchain is that it simply does not meet our customers or their consumers’ demand for real-time transactions, inter-operability and customization.

So imagine that if Visa or Mastercard can process 5,000 transactions per second with the capacity to process more, Bitcoin can only process 12 per second but with the first transaction taking 10 minutes to settle. From what I understand, Amadeus processes over 50,000 transactions per second and over 50 million per day. Slowness and an IT platform’s inability to adapt on demand to customer-specific modifications and enhancements are show-stoppers in our industry. This doesn’t mean that Blockchain is not suitable but that for services like shopping, today the technology is just too slow and missing the necessary interfaces in order to make it end-user friendly.

When we got to the topic of whether cryptocurrencies were a valuable means for start-ups to raise capital, my fellow panelists were all very enthusiastic. As Amadeus does not have a position on cryptocurrencies, I kept my opinion to myself. Personally, I don’t buy the emotional argument that cryptocurrencies give more “control” to the individual over his money, or that they ultimately add value and enhance the marketplace for new ideas in ways that fiat money and the current regulations cannot.

Quite the contrary: investors want liquid markets where they can easily get their money in and out of ventures. Furthermore, efficient market theory tells us that the value of a security should reflect all available information in the market. Tech entrepreneurs may love the idea that they can cheaply raise large quantities of cryptocash without the costs and hassles of having to comply with regulations, but in the long run transparency and certainty create dynamic markets. You can raise more money on the U.S. stock exchange than say on the Indonesian one because investors know that they can easily exist an investment and that the market is efficient.

With the original securities acts of 1933 and ’34, the U.S. government wasn’t trying to protect the sophisticated investor from big corporate greed. The regulations were designed to protect the unknowing from being bamboozled by scams and ponzi schemes. They demanded transparency and disclosure of risks, exactly what today’s ICO market tends to lack with fairly scandalous, yet predictable results:

A recent study prepared by ICO advisory firm Statis Group revealed that more than 80 percent of initial coin offerings (ICOs) conducted in 2017 were identified as scams. The study took into consideration the lifecycle of ICOs run in 2017, from the initial proposal of a sale availability to the most mature phase of trading on a crypto exchange.

And if you thought you had just raised $30 million over night in Bitcoin, what is your money worth today?

Bull run? Crypto-currencies are bust. BTC down 70% this year. Other major ones down 80%. The rest down 95%. Major cryptos down another 10% yesterday alone. In which La La Land do these Crypto Lunatics live? They can’t think as they lost 90% in less than a year. Wake up! https://t.co/dFQIJ6oRJR

— Nouriel Roubini (@Nouriel) October 11, 2018

So why should we think that the marketplace needs cryptocurrencies to raise capital? Certainly new ventures like AirBNB, Whatsapp, Facebook, WeChat, Twitter, Instragram, Uber, Booking.com etc successfully raised capital with old fashioned money. The more I hear someone claim that cryptocurrencies will democratize money, the more I am convinced that the speaker has either absolutely no idea what he is talking about or is full of crypto-crap. That doesn’t mean that the current VC model is not a scam itself. To a certain degree it is. But paying workers in tokens instead of money or promising investors they’ll get rich quick without full disclosure is not the solution. It’s a swindle.

If you ask me, we shouldn’t be talking about Blockchain at all. Yes, I think it will be an important back-office tool to improve efficiencies, but not life-altering. What we should all be talking about is Artificial Intelligence which — for better or worse — is the real game changer.

Finally, I really enjoyed the opportunity to speak at the event. When I got off stage, I remembered something that Bill Clinton once said shortly after leaving the presidency: the hardest thing about no longer being president was walking into a room and not being greeted with the presidential anthem. In other words, being on stage is addictive. It feels good to be listened to and treated with undeserved respect. Earlier in my career, I spent a lot of time speaking in public, and last week at the South Summit, I remembered how much fun it was to be on center stage, especially when afterwards you get to interact with very smart people. And the icing on the cake: running into friends and former colleagues at South Summit and reminiscing about the good old days.

Thanks all around to everyone involved, especially my excellent colleagues in CST.

The more I hear Blockchain evangelists preach about tokenization and how cryptocurrencies will democratize technology, the more I am convinced that cryptocurrencies are one big swindle. I have already discussed this more in depth

The more I hear Blockchain evangelists preach about tokenization and how cryptocurrencies will democratize technology, the more I am convinced that cryptocurrencies are one big swindle. I have already discussed this more in depth

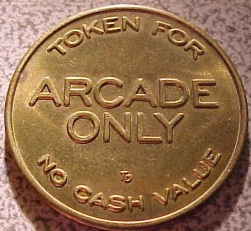

Think of cryptocurrencies as those tokens at a video arcade where in exchange for hard currency (or services), you are given tokens that can be used at the arcade. The tokens would generally have no value outside of the arcade, unless there is demand for exchanging goods, services, or other currencies for those tokens.

Think of cryptocurrencies as those tokens at a video arcade where in exchange for hard currency (or services), you are given tokens that can be used at the arcade. The tokens would generally have no value outside of the arcade, unless there is demand for exchanging goods, services, or other currencies for those tokens. We keep hearing that governments will kill cryptocurrencies or at least regulate them to death. They fear what they cannot control (or tax). I tend to keep a more open mind.

We keep hearing that governments will kill cryptocurrencies or at least regulate them to death. They fear what they cannot control (or tax). I tend to keep a more open mind.